News

Bitcoin News

Bitcoin News

Browse all Bitcoin related articles and news. The latest news, analysis, and insights on Bitcoin.

Strategy Bought a Huge Amount of Bitcoin

Institutional investor interest in Bitcoin is gaining momentum. Strategy (formerly MicroStrategy), the US-based Bitcoin treasury company, and The Blockchain Group, Europe's first Bitcoin treasury company, announced a total of hundreds of millions of dollars in BTC purchases. Strategy increases Bitcoin holdings to 582,000Strategy, led by Michael Saylor, bought 1,045 BTC between June 2 and June 8. According to an 8-K filing with the U.S. Securities and Exchange Commission (SEC), the purchase cost approximately $110.2 million, at an average price of $105,426 per unit. The company's total Bitcoin holdings reached 582,000 BTC, reaching a market capitalization of about $62 billion.Saylor revealed that the company has so far purchased about $40.8 billion worth of BTC at an average cost of $70,086. This is equivalent to 2.8% of Bitcoin's total supply of 21 million. The company's earnings on paper are around $21 billion.These latest purchases were funded by the proceeds from the sale of the company's perpetual preferred shares, STRK and STRF. STRK is a convertible preferred stock offering an 8% fixed dividend, while STRF offers a 10% fixed dividend but is non-convertible. Last week, Strategy also launched a $1 billion sale of STRD, a new stock with a 10% fixed dividend.300 million euro plan from Blockchain GroupOn the other hand, on the European front, France-based The Blockchain Group announced the launch of a new 300 million euro (approximately $342.5 million) in-market capital raising program for Bitcoin purchases. The program allows new shares to be issued after the close of each trading day under an agreement with French asset manager TOBAM. The shares will be priced at the higher of that day's closing price or the volume-weighted average price and will be limited to 21% of trading volume.Last week, the company announced the purchase of 624 BTC for approximately $68.7 million. With this new purchase, the total amount of Bitcoin held by The Blockchain Group reached 1,471 BTC. This strategy, modeled after at-the-market (ATM) programs in the US, is quite similar to the model Strategy has implemented. However, TOBAM plans to remain a shareholder by holding shares, not just selling them. This suggests that the European model is more strategic and long-term than the US version.These two big moves show that institutional investors' appetite for Bitcoin is not waning, but rather growing. Metaplanet's $5.4 billion capital raising plan announced last week and the fact that companies like GameStop and Trump Media are also turning to the Bitcoin model show that the “Bitcoin treasury” trend started by Saylor is growing on a global scale.

BTC Comments and Price Analysis 9 June 2025

Bitcoin Technical Analysis – Critical Touch at the Upper Band of the Descending ChannelOn the 4-hour chart, Bitcoin has reached the upper boundary of the descending channel it has been moving within for a while. The price is currently at $106,563. The key technical threshold at $107,171, which is the upper limit of the channel, is now being tested. The first notable detail on the chart: The price has reached both the descending trendline and the horizontal resistance zone of $106,595–$107,171. Without a breakout of this area, it’s difficult to talk about a clear upward momentum.If a breakout occurs, a target equal to the height of the channel would form based on the technical structure. The lower band of the channel lies around $99,300, while the upper band is near $107,000. In case of an upward breakout, the target could be in the $113,000–$114,000 range.However, volume confirmation is crucial at this point. Without daily closes above this resistance zone, it’s too early to say the breakout is permanent. Especially closes above $107,171 could accelerate momentum.In the downside scenario, the first level to watch is $104,977. If this support is broken, BTC may slide back down within the descending channel, targeting first $102,137 and then the $99,300 support zone.In summary:BTC is testing the upper band of the descending channel.A close above $107,171 could confirm an upward breakout.If confirmed, the target could be in the $113,000–$114,000 range.On the downside, $104,977 and $102,137 support levels should be watched closely.As the decision point approaches, volume and closing prices will be key.

Daily Market Summary with JrKripto 9 June 2025

You can find today’s edition of “Daily Market with JrKripto,” where we compile the most important developments in global and local markets, below. Let’s analyze the general market conditions together and take a look at the latest evaluations.Bitcoin (BTC) dropped as low as $101,150 after breaking down from the ascending channel on the 4-hour chart and losing the $104,977 support. This decline, supported by high-volume selling, was also influenced by the political tension between Trump and Musk. However, with a strong reaction from the $101,059–$100,063 zone, the price is now around $103,200.Holding this support zone increases the likelihood of a recovery. In upward moves, the $102,137 and especially the $104,977 resistance levels are important. Without a break above $104,977, it’s difficult to talk about a sustained rise. Otherwise, $96,914 and $96,115 levels could come back into play.Ethereum (ETH) declined from the $2,838 level down to the $2,385 support. With a bounce from this zone, it is now trading around $2,460. The $2,385 level continues to be monitored as strong support. If this level is breached, the $2,098 and $2,004 support levels may come into focus.For upward recovery to gain strength, the $2,711 resistance must be broken first. If this level is broken, $2,838 may be targeted again. Holding above $2,385 is critical for the continuation of the positive scenario.Crypto NewsTether minted $1 billion in USDTNasdaq filed a SEC Form 8-K proposing to expand its crypto benchmark index from 5 to 9 assets, adding $XRP, $SOL, $ADA, and $XLMPresident Trump said his relationship with Elon Musk is over$1.5 trillion Deutsche Bank is considering launching its own crypto stablecoinPresident Trump: “We’ve made a lot of progress on the 🇺🇸🇨🇳 China deal”Eric Trump announced a partnership between World Liberty Financial and the $TRUMP meme coinCrypto company Gemini submitted a confidential IPO application in the U.S.Top Gainers in CryptocurrenciesRVN → Up 16.5% to $0.01812467KAIA → Up 15.6% to $0.12306084ICP → Up 10.3% to $5.85FARTCOIN → Up 8.3% to $1.08KTA → Up 8.2% to $1.62Top LosersEVOLVE → Down 91.1% to $0.0000292DEXE → Down 16.7% to $8.85EOS → Down 11.2% to $0.56714183LPT → Down 8.7% to $7.55ZBCN → Down 7.0% to $0.00446442Fear IndexBitcoin: 60 (Greed)Ethereum: 50 (Neutral)DominanceBitcoin: 64.63% ▲ 0.09%Ethereum: 9.27% ▼ 0.45%Daily Net ETF FlowsBTC ETFs: -$47.80 millionETH ETFs: $25.30 millionGlobal MarketsGlobal markets are starting the week with cautious optimism, focusing on the high-level U.S.–China trade talks beginning in London. While Asian stock markets are rising, U.S. and European futures are showing slight declines. A mixed trend prevails in U.S. markets: strong employment data (139,000 new jobs) supported a recovery in tech stocks, but Tesla and other sensitive stocks remain volatile.On the macro front, signs of a slowdown in the U.S. economy continue: ADP private sector employment rose by only 37,000 in May, and the ISM services PMI fell to 49.9, indicating contraction. Eurozone services PMI data fell to 49.7 in May, and the ECB conducted its eighth interest rate cut of the year.Asian markets, meanwhile, are showing positive sentiment. The MSCI Asia-Pacific Index rose by 0.7%, Nikkei by 0.9%, and Hang Seng by 0.8–1.4%. Gold rose by 0.4% due to safe-haven demand, reaching around $3,323.7/oz, while platinum is also recovering. Oil prices slightly declined due to weak data from China (WTI ~$64.43, Brent ~$66.29), but are supported by hopes surrounding U.S.–China talks.The OECD has revised its global growth forecasts for 2025–2026 downward from 3.3% to 2.9%. U.S. growth is expected to fall to 1.6%, and China’s to 4.3% from 4.7%. This week, markets are focused on U.S. CPI and non-farm payroll data, post-ECB European bond yields, and tangible signals from the trade talks in London.Overall, while risk appetite is supported by strong jobs data and the U.S.–China talks, weak economic indicators and geopolitical uncertainty suggest that cautious pricing will continue.Most Valuable Companies and Stock PricesMicrosoft (MSFT) → $3.5 trillion market cap, $470.38 per share, +0.58%NVIDIA (NVDA) → $3.46 trillion market cap, $141.72 per share, +1.24%Apple (AAPL) → $3.05 trillion market cap, $203.92 per share, +1.64%Amazon (AMZN) → $2.27 trillion market cap, $213.57 per share, +2.72%Alphabet (GOOG) → $2.11 trillion market cap, $174.92 per share, +3.01%Precious Metals and Exchange RatesGold: 4,189 TLSilver: 45.82 TLPlatinum: 1,526 TLDollar: 39.22 TLEuro: 44.90 TLSee you again tomorrow with the latest updates!

The US Congress Updated the Crypto-Focused CLARITY Act

The US Congress has taken an important step for the long-awaited clarity in cryptocurrency regulations. Members of Congress introduced an updated version of the CLARITY Act, a bill that aims to unify the laws overseeing the crypto market. The new draft is called the “Alternative Amendment”, or officially “Amendment in the Nature of a Substitute” (ANS), and will be debated at the House Financial Services Committee hearing on June 11.Update to cryptocurrency law in the USThe new bill contains positive regulations, especially for developers and decentralized finance (DeFi) projects. Crypto developers and wallet providers will not be considered “money transfer service providers” if they do not have direct control over user funds. This means that DeFi tools and software where users store their private keys will be exempt from existing money services regulations. Furthermore, Bank Secrecy Act (BSA) rules will only apply to centralized intermediaries. This means that decentralized finance (DeFi) projects will be relieved of some regulatory pressure. However, the law also introduces new provisions for banks regarding the use of digital assets. National banks will be able to offer legal services using digital assets and blockchain technology. However, these activities must be conducted in accordance with existing regulations. The same rights will apply to insured state banks and their subsidiaries.The CLARITY Act mainly aims to clarify the classification of crypto-assets, the mandate of regulators and the rules to which market players are subject. The delineation of jurisdictional boundaries between the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) is crucial for the future of digital assets such as Bitcoin, Ethereum and stablecoins.The amendments to the bill have been welcomed in the market. In particular, software developers and the DeFi community have welcomed the emphasis on the principle of “decentralization” in the bill. However, some experts note that this concept is difficult to define in the legal framework. Former CFTC Chairman Timothy Massad warned that over-reliance on decentralization could mean building regulation on an uncertain concept that could change over time.Bitcoin reserve bill submitted to CongressIn the shadow of these legislative developments, another notable move came from Republican Representative Tim Burchett. Burchett introduced H.R. 3798, a bill to enact the strategic Bitcoin reserve plan proposed by former President Donald Trump. If passed, the US government would officially begin creating a Bitcoin reserve. Supporters argue that this plan would boost the US economy and increase crypto adoption, while critics point to Bitcoin's volatility.

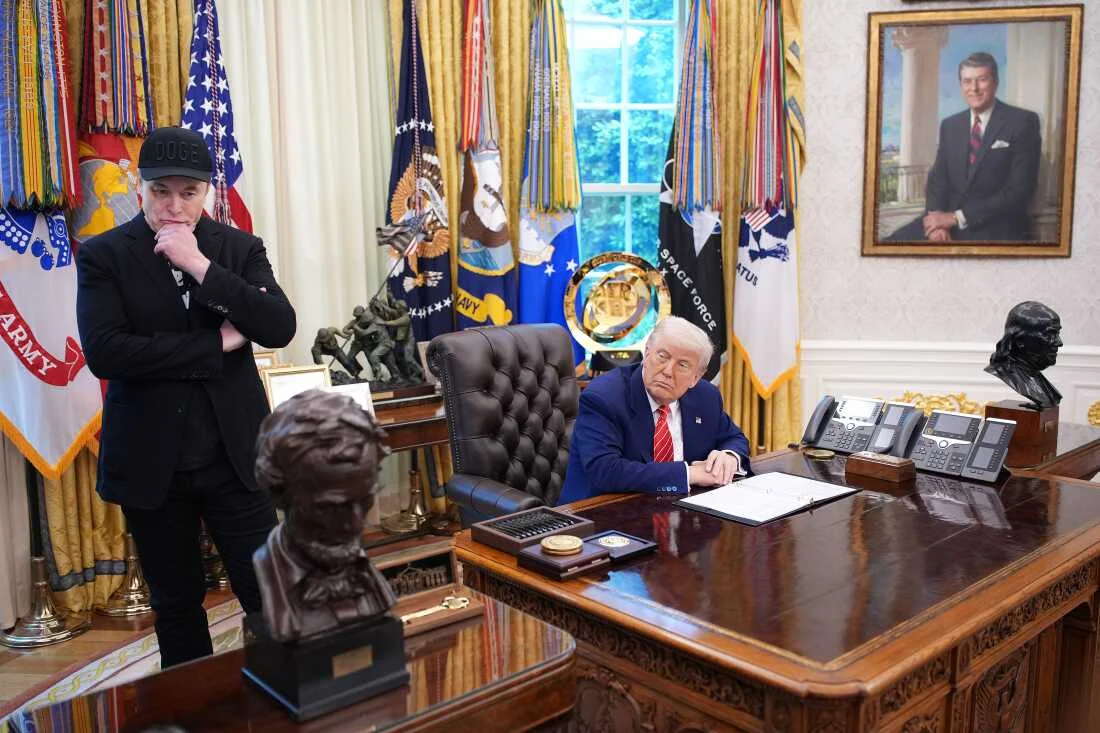

The Fight Between Elon Musk and Donald Trump Hit the Crypto Market!

The highly publicized confrontation between US President Donald Trump and Tesla and SpaceX CEO Elon Musk has caused serious volatility not only in Washington but also in the crypto markets. In particular, Musk's outburst against Trump's controversial spending bill, dubbed the “Beautiful Bill”, led to a sharp sell-off in Bitcoin and altcoins. Spot ETF outflows, billion-dollar-plus liquidations and shaken investor confidence left markets with one of the harshest days of June 2025.A wave of selloff in the crypto market: $1 billion in liquidationsMusk-Trump tension has turned the markets upside down. The price of Bitcoin (BTC) fell by over 4% to around $100,000, while leading altcoins such as Ethereum (ETH), Solana (SOL), XRP and Binance Coin (BNB) lost between 4% and 8%. Ethereum, in particular, hit a weekly low of $2,400 after being rejected at $2,700. According to Coinglass data, $260 million worth of long positions were liquidated in ETH futures alone. The total value of cryptocurrencies dropped from $3.4 trillion to $3.3 trillion. Total daily liquidations exceeded $ 1 billion. On the Bitcoin side alone, $341 million worth of positions were closed. Most of these liquidations were due to long positions. Yesterday's $278 million outflow from spot BTC ETFs also shows that institutional investors are reacting to the uncertainty caused by the Musk-Trump conflict. Heavy accusations from Elon Musk against TrumpThe issue that sparked the tension was the giant spending bill in Congress. Elon Musk slammed the bill, arguing that it “disgraced” the US budget. Twitter founder Jack Dorsey supported Musk by suggesting Bitcoin as an alternative in this process. In his response, Trump announced that he would cancel Musk's government contracts. Musk responded to this threat by announcing that SpaceX would retire the Dragon spacecraft.But the tension did not end there. Musk signaled a new scandal by claiming that Trump was named in the Epstein documents and therefore had not released them until now. These statements shook the balance in Washington and weakened Elon Musk's position on the political front. Musk loses $27 billion, Tesla shares plummetElon Musk's harsh outbursts against Trump have shaken both his political allies and his financial power. As it is known, Musk frequently voiced his support for Trump during Trump's presidential campaign. While Tesla shares fell, Musk lost a fortune of 27 billion dollars this week alone, according to Forbes data. He is still the richest person with a fortune of 388 billion dollars.In the House of Representatives, many Republicans openly criticized Musk while supporting Trump. Texas Republican Troy Nehls lashed out at Elon, saying, “He's acting like he's out of his mind.” Florida Representative Aaron Bean, known as a DOGE supporter, described it as “two friends getting into a fight,” but his efforts to defuse the situation were ineffective.Are we entering a new period of uncertainty for the crypto sector?This conflict between Musk and Trump directly affects both the tech world and the crypto markets. In particular, Musk-influenced assets such as Bitcoin and DOGE are now more fragile due to the political winds. On the other hand, although new liquidity inflows to crypto markets are expected if the spending bill is passed, political tensions seem to overshadow investor confidence in the short term.

Daily Market Summary with JrKripto 6 June 2025

You can find today’s edition of “Daily Market with JrKripto,” where we compile the most important developments in global and local markets, below. Let’s analyze the overall market conditions together and review the latest insights.Bitcoin (BTC), after starting its long-term uptrend at $75,930 and reaching an all-time high (ATH) of $111,980, faced strong profit-taking. The downward break of the ascending channel on the 4-hour chart, followed by the loss of the $104,977 support, pushed the price quickly down to around $101,150. This drop, accompanied by high-volume selling across the last four candles, signals more than a mere technical breakdown—it indicates a decisive wave of selling. Additionally, the political tension between U.S. President Trump and Elon Musk has increased market uncertainty, further supporting the bearish pressure.BTC is currently trading around $103,200, with the $101,059–$100,063 range standing out as a strong support zone. This area previously attracted buying interest and is once again showing signs of buyer re-entry. If this zone fails to hold, the next levels to watch are $96,914 and $96,115. On short-term recoveries, the $102,137 and especially the $104,977 levels should be monitored as resistance. As long as these levels remain unbroken, upward moves are likely to stay limited. However, the price has shown a notable reaction from the current support zone, increasing the probability of a short-term rebound.Ethereum (ETH) tested $3,004 after climbing from $1,486, but has since entered a correction and is now trading at $2,460. Technically, the $2,385 level acted as critical support and sparked a significant bounce, though price action remains close to this zone. If this support fails, $2,098 and $2,004 are the next levels to follow.For bullish momentum to resume, ETH must break above the $2,711 resistance. If this level is cleared, targets include $2,838 and $3,004. Like BTC, ETH has also seen a meaningful bounce from support. Sustaining above $2,385 is essential to maintain the positive outlook.Crypto NewsThe European Central Bank (ECB) implemented a 25bp rate cut.Chinese state media reported a conversation between President Trump and President Xi.BounceBit added support for $USD1, the stablecoin of World Liberty Financial.Circle, issuer of USDC, saw its stock surge 200%, rising from its $31 IPO price to $94.41.Uber is reportedly exploring the use of stablecoins as a payment method.World Liberty Financial sent a cease and desist notice to Fight Fight Fight LLC, the issuer of the Trump memecoin.Truth Social registered Bitcoin and Ethereum ETFs in Nevada.Tesla lost $150 billion in market cap, marking the biggest loss in the company’s history.Top Gainers in CryptoFARTCOIN → Up 15.6% to $1.04COMP → Up 12.9% to $49.36LA → Up 6.1% to $1.54GRASS → Up 4.5% to $1.99KTA → Up 4.4% to $1.08Top Losers in CryptoRVN → Down 34.6% to $0.01458774LDO → Down 11.3% to $0.7718249TRUMP → Down 10.4% to $9.72JUP → Down 9.6% to $0.46357394DOG → Down 9.1% to $0.00425333Fear IndexBitcoin: 51Ethereum: 41DominanceBitcoin: 64.56% ▲ 0.01%Ethereum: 9.35% ▲ 0.24%Daily Net ETF FlowsBTC ETFs: -$278.40 millionETH ETFs: $11.30 millionKey Economic Data to Watch Today15:30 – Average Hourly Earnings (MoM) (May)Forecast: 0.3% / Previous: 0.2%15:30 – Non-Farm Payrolls (May)Forecast: 126K / Previous: 177K15:30 – Unemployment Rate (May)Forecast: 4.2% / Previous: 4.2%Global MarketsAs of the morning of Friday, June 6, 2025, global markets are preparing to end the week with cautious optimism. The resumption of high-level trade talks between the U.S. and China has supported global risk appetite, though weak economic data and political tensions are keeping investors cautious.U.S. stock markets have shown a volatile trend. Tesla shares fell sharply after Donald Trump criticized Elon Musk. Trump's statement that he may cancel government contracts with Musk’s companies increased selling pressure on tech stocks. Following this, the Nasdaq declined, while the S&P 500 and Dow Jones ended the day with slight losses.On the macro front, weak data stood out. The ADP private sector employment report showed an increase of only 37,000 jobs in May—the lowest since March 2023. Meanwhile, the ISM services PMI fell to 49.9, signaling contraction in the services sector. These indicators suggest a deepening slowdown in the U.S. economy.In Europe, the ECB delivered its eighth rate cut of the year. However, the Eurozone services PMI also dropped to 49.7 in May, reinforcing signs of ongoing economic weakness in the region.Asian markets are performing more positively. China’s services PMI exceeded expectations, boosting buying appetite, especially in the Hong Kong and Japanese markets. Regional markets began the final trading day of the week on a strong note.Meanwhile, the OECD revised its global economic growth forecasts downward. Growth expectations for both 2025 and 2026 have been updated to 2.9%. The report cited uncertainty in trade policy, tightening financial conditions, weakening consumer confidence, and rising political risks as serious threats to growth.Today, global market attention will focus on the U.S. non-farm payrolls data. A weaker-than-expected figure could strengthen expectations for an earlier rate cut by the Fed. However, continued geopolitical tensions and weak economic indicators suggest cautious market sentiment will persist.Most Valuable Companies and Stock PricesMicrosoft (MSFT) → $3.48 trillion market cap, $467.68 per share, +0.82%NVIDIA (NVDA) → $3.42 trillion market cap, $139.99 per share, -1.36%Apple (AAPL) → $3 trillion market cap, $200.63 per share, -1.08%Amazon (AMZN) → $2.21 trillion market cap, $207.91 per share, +0.33%Alphabet (GOOG) → $2.05 trillion market cap, $169.81 per share, +0.25%Precious Metals and Exchange RatesGold: 4,245 TLSilver: 45.66 TLPlatinum: 1,475 TLUSD: 39.29 TLEUR: 44.91 TLSee you again tomorrow with more market updates!

BTC Comments and Price Analysis 5 June 2025

Bitcoin (BTC) Technical Analysis – 4-Hour Chart Current Outlook of BTC has broken below its ascending channel on the 4-hour chart and then lost the $104,977 support, leading to a sharp decline in value. After the breakdown, the price dropped as low as $101,150. The steep decline over the last four candles indicates that this move wasn't random; it reflects a strong and determined wave of selling, backed by volume.Not Just Technicals—Political Factors at PlayThe drop isn’t solely driven by technical indicators. A heated dispute between U.S. President Donald Trump and Elon Musk has shaken market sentiment. Trump referred to Musk as “crazy” and announced that government support for companies like Tesla and SpaceX would be cut off—indirectly impacting the crypto markets. Musk didn’t stay silent and openly responded to Trump. This back-and-forth has heightened uncertainty, especially among crypto investors.What Does the Technical Picture Show?Bitcoin is currently trading around $101,500. If it drops below this level, the $100,063–$99,289 range stands out as the first major support zone. This area has previously seen buying interest and upward price bounces.If this zone also fails to hold, the next support lies at $96,914. In other words, the $100,000 psychological threshold is of critical importance—if it breaks, the decline could accelerate significantly.On the other hand, in short-term recovery attempts, the $102,137 and particularly the $104,977 levels should be watched as resistance. Unless these areas are broken, any upward movement may remain weak and could be seen as selling opportunities.In Summary:Bitcoin is currently under technical pressure.Unless there’s a close above $105,000, the downtrend seems likely to continue.$100,000 is a key psychological level—dropping below could trigger panic selling.Political developments will continue to influence price direction in the short term.There is no clear sign of recovery at this point, so investors should remain cautious and closely monitor both technical levels and news flow.

Trump and Xi Held a Phone Call! Crypto Investors Alerted

As trade tensions between the US and China escalate again, Thursday's phone call between former US President Donald Trump and Chinese President Xi Jinping has once again turned the attention of global markets to the relationship between the two superpowers. The call, announced by China's official news agency Xinhua, was the first direct contact between the two leaders since their last contact in January. However, this contact does not mean that tensions will ease. This is because both sides accuse each other of reneging on the temporary trade truce reached in Geneva last month. This tension is creating a new environment that could affect both commodity prices and the course of Bitcoin and other digital assetsTrump: “Xi is extremely difficult to deal with”According to the Financial Times, just a day before the meeting, Trump had described Chinese leader Xi as “an extremely difficult person to deal with”. This statement was seen as a signal that the US would take a tougher stance against Beijing, while Washington's criticism of China's failure to fulfill its promises gained momentum. US officials are particularly concerned about delays in licensing processes for the export of rare earth elements and magnets. These materials are used in many critical sectors, from defense to electronics, and the US side argues that China is deliberately restricting the flow of these products.Beijing, for its part, accuses Washington of seriously violating the Geneva agreement. The Chinese Foreign Ministry has said that the new US warnings on the global use of Huawei chips, the halt on the sale of chip design software to Chinese companies and the revocation of visas for Chinese students are completely contrary to the spirit of the agreement.These mutual accusations suggest that a new compromise between the two countries will be difficult in the near term. Moreover, this crisis has not only affected the traditional trade sphere, but also wider areas such as technology and education.What does it mean for Bitcoin and crypto markets?A deepening trade war could affect cryptocurrency markets as much as traditional financial markets. In particular, new sanctions or supply chain disruptions between the US and China could trigger investors to turn to safe-haven assets. At this point, decentralized assets such as Bitcoin may come to the fore again during periods of increased geopolitical risks. In recent years, Bitcoin's positioning in the face of the economic policies of both China and the United States has been a carefully watched area of development for investors. China's past mining bans and US regulatory crackdowns clearly demonstrate the influence of these two superpowers on crypto. Therefore, deepening tensions between the two countries could mean both risk and opportunity for the crypto ecosystem. However, it is worth noting that these are only speculations. So, every investor should do their own research.

The US Seized $17 Million Cryptocurrency

US law enforcement has dealt a major blow to BidenCash, one of the dark web's best-known illegal marketplaces. According to a statement by the Department of Justice, 145 internet domains linked to BidenCash and approximately $17 million in cryptocurrencies were seized as part of the FBI-led operation.More than 15 million credit card details soldBidenCash, which has been operating since 2022, attracted attention by selling stolen credit card information, personal data and compromised login credentials on the dark web and open internet. The platform offered its users the opportunity to pay anonymously with cryptocurrency, providing both privacy and making it difficult to track. BidenCash, which is thought to have generated at least $17 million in revenue, served approximately 117,000 users.The platform also reportedly released millions of credit card details for free from time to time to expand its illegal operations. According to officials, between October 2022 and February 2023, 3.3 million credit card details were shared for free for promotional purposes. This data included highly sensitive information such as card numbers, expiration dates, CVV codes, first and last names, addresses, e-mail and phone numbers.A major operation was carried out with global cooperationThe operation was not limited to the US. In addition to the FBI, the US Secret Service, the Dutch National Police, and cybersecurity organizations such as the Shadowserver Foundation and Searchlight Cyber were also part of the operation. The 145 domains in question are currently redirected to official US government seizure pages. However, according to Arkham Intelligence data, authorities seized approximately $43,000 in Tether (USDT) assets during the operation. Although BidenCash's infrastructure was largely taken down, cybersecurity experts revealed that some domains linked to the platform are still active. Security researcher Vmprotect, using a tool called Domainhunter.pro, has identified at least seven active domains.New era against crypto-focused crimesThe year 2025 is characterized by law enforcement's tough fight against dark web and crypto-based crimes. In May, Europol detained hundreds of people in 10 different countries as part of “Operation RapTor” against the cryptocurrency-funded fentanyl trade. The BidenCash operation is seen as an extension of this global crackdown.Cryptocurrencies are frequently preferred for illegal activities due to their privacy and ease of cross-border transfer. However, as we have seen in examples like BidenCash, it is impossible to say that these illegal systems are “undetectable”.

Surprise Bitcoin Decision by British Gold Mining Company: Converting Revenues to BTC

Bluebird Mining Ventures Ltd., a gold mining company listed on the London Stock Exchange and operating in Asia, is merging traditional mining with digital assets. The company has announced a bold strategic transformation plan. The company plans to transition to a “digital gold” model by converting revenues from its flagship project in the Philippines into Bitcoin. The move is a first for a UK-based mining company.Bluebird to buy BitcoinBluebird completed the license renewal process for its gold project in the Philippines on May 6, 2025. Since then, negotiations with local partners have progressed positively. The company expects these negotiations to result in a binding agreement in the near future. With the new agreement, Bluebird will be able to continue to receive a profit share in the project without incurring any additional costs until the production phase. On the other hand, the company is preparing for the legal process to protect the value of its mining projects in South Korea. The company's legal team has completed the documents for the administrative lawsuit, which is planned to be filed before June 18, 2025. As the fate of the projects in South Korea remains uncertain, Bluebird is exploring alternative ways to capitalize on these assets without seeking new investment.The company's most notable move, however, is its new treasury management strategy, which aims to convert future revenues into Bitcoin. The company plans to systematically convert its gold earnings into Bitcoin and hold the digital asset on its balance sheet as a long-term reserve asset. Thus, it aims to offer investors returns on both traditional and digital custodians of value.Gold and “digital gold” togetherBluebird's Interim CEO and Board Member Aidan Bishop said: “I am very pleased with the negotiations in the Philippines, and once this process is successfully completed, Bluebird will maintain a stake in the project with no future cash obligations.” He also emphasized that with the “gold plus digital gold” strategy, the company can move forward with stronger steps into the future.The company is also looking for a new CEO to lead this transformation. With the leadership of an experienced name in crypto assets, Bluebird aims to appeal to a more innovative and technology-oriented investor profile.Bluebird currently owns two former gold and silver mines in South Korea, Gubong and Kochang, as well as the Batangas Gold Project in the Philippines, with a total gold reserve of approximately 1.8 million ounces. So far, $9 million in investment commitments have been received for these projects.MicroStrategy was the first company to adopt Bitcoin as a reserve asset. Following MicroStrategy's (now just Strategy) purchase of Bitcoin in 2020, many companies have made up their minds to add BTC to their treasury.

Moscow Exchange Gives Green Light to Bitcoin ETFs

The Moscow Exchange (MOEX), Russia's largest stock exchange, has launched futures contracts for the iShares Bitcoin Trust ETF (IBIT) launched by BlackRock, which has attracted considerable interest. Announced on June 4, this new product is designed to be open only to qualified investors. MOEX also plans to introduce a qualification testing process for investors starting June 23.The move coincides with IBIT taking its place among the 25 largest ETFs globally. IBIT's assets under management (AUM) topped $72.4 billion, according to Eric Balchunas, senior ETF analyst at Bloomberg. Launched in January 2024, the fund has made waves in the ETF world, achieving this feat in just 1.4 years.Demand for crypto products is growing in RussiaMOEX's introduction of the IBIT-based futures product is significant for crypto investment vehicles in Russia. In May, the Central Bank of Russia approved the use of crypto-linked securities and derivatives, limited to qualified investors only. Following this decision, actors such as Sberbank and T-Bank, one of the country's largest banks, started to offer financial products based on Bitcoin. Among the products offered by Sberbank are also structured bonds that track the Bitcoin price and the dollar-ruble exchange rate.The newly launched futures are priced in US dollars but are exchanged for Russian rubles in cash. With the first maturity set for September 2025, these contracts are in line with MOEX's strategy to offer indirect investment opportunities in crypto. Similarly, the Saint Petersburg Stock Exchange has started testing cash-settled futures products, according to TASS.Individual investors are not satisfiedDespite these developments, individual investors in Russia are expressing their dissatisfaction that the new products are aimed only at qualified investors. According to MOEX data as of May 2025, there are 36.9 million individual investor accounts on the exchange. Of these, only 315 thousand are qualified investors.IBIT is making a name for itself with recordsIBIT, BlackRock's Bitcoin ETF, continues to break historic records since its launch in January 2024. With nearly $15.5 billion in inflows in just three months, IBIT has become one of the ETFs with the longest fund inflow streak of all time. “It's like a baby hanging out with teenagers,” said Balchunas, Bloomberg's ETF expert.

Trump Slams Powell After Weak ADP Report: How Did Bitcoin React?

US President Donald Trump sent a harsh message to FED Chairman Jerome Powell after the ADP employment data for May, which fell well below expectations. In a post on the social media platform Truth Social, Trump called on Powell to cut interest rates, citing the European Central Bank as an example and arguing that the US was late in monetary policy. Trump's outburst, along with signs of weakening economic indicators, has renewed interest in alternative assets such as Bitcoin.Donald Trump slams FED ChairmanUS President Donald Trump once again lashed out at US Federal Reserve (FED) Chairman Jerome Powell on his Truth Social account after the release of the ADP private sector employment data for May. In his post, Trump demanded a cut in interest rates, cited Europe as an example and gave a direct message to Powell: “He is too late”.Trump gave the following statement: ““Too Late” Powell must now LOWER THE RATE. He is unbelievable!!! Europe has lowered NINE TIMES!” Trump's outburst came just after the May private sector employment data released by the ADP Research Institute and the Stanford Digital Economy Lab fell short of expectations. According to the report, the US economy created only 37,000 jobs in May. This figure was well below the market expectation of 114,000.ADP's chief economist Dr. Nela Richardson noted that despite this slowdown in job growth, wage growth remained strong and there were still signs of resilience in the labor market. However, according to Richardson, after a strong start to the year, there has been a serious slowdown in hiring.Trump has been pressuring Powell to cut interest rates for months. However, the Fed chairman has so far ignored these calls and often reiterated his data-driven monetary policy rhetoric. The European Central Bank, which Trump made comparisons with, has cut interest rates in recent months.So how is Bitcoin doing in the shadow of these discussions?According to the latest data, Bitcoin (BTC) is trading at $105,038 at the time of writing. This represents a slight decline of about 0.31% in the last 24 hours. BTC, which tested the $112,000 level in May, has managed to stay above $100,000 thanks to strong demand and capital flows into ETFs. While the uncertainty over the Fed's interest rate policy is driving investors to alternative assets, Bitcoin stands out in this equation with its safe-haven perception again. If Trump's calls for interest rates are answered, the dollar weakens and yields fall, BTC may regain strength in the coming days.Weak employment data from the US has also made the upcoming official non-farm payrolls report more critical, while investors have turned their eyes to the Fed's next step.

Daily Market Summary with JrKripto 4 June 2025

You can find today’s edition of “Daily Market with JrKripto,” where we compile the most important developments in global and local markets, below. Let’s analyze the overall market conditions together and review the latest insights.Bitcoin (BTC) extended its long-term uptrend from $75,930 to reach an all-time high (ATH) of $111,980. Following this peak, it pulled back due to profit-taking and is currently trading around $105,000. On the technical side, $104,629 stands out as the first major support level. If this area is breached, $101,059 and then $96,115 should be monitored as the next support zones. For the upward recovery to gain traction, it is critical for BTC to surpass the $109,588 resistance. If this resistance is broken, $111,980 and then $114,500 may be targeted once again. Maintaining price action above $104,629 is important to preserve the positive trend.Ethereum (ETH), after starting a strong rally from $1,486 and reaching a peak of $3,004, has entered a correction phase and is currently trading at $2,620. The price holding above the $2,385 support level is helping to limit selling pressure; however, if this level is breached, $2,098 and $2,004 will become the next support zones. For the upward momentum to continue, ETH must break the $2,711 resistance level. Once this is achieved, the targets will be $2,838 and $3,004. The continuation of the positive outlook for ETH hinges on its ability to remain above $2,385.Crypto NewsFed member Bostic said a rate cut this year may be possible depending on the state of the economy.Treasury Secretary Bessent said it’s up to China to decide whether it wants to be a reliable partner.North America-based civil engineering firm SolarBank adopted a Strategic Bitcoin Reserve.Trump is set to launch a branded crypto wallet and trading app encouraging supporters to buy memecoins and other crypto assets.Magic Eden’s $ME partnered with Trump Wallet.Top GainersCOMP → Up 15.2% to $47.60BORG → Up 15.1% to $0.20837302ZBCN → Up 11.2% to $0.0052459ATH → Up 10.6% to $0.05030066APE → Up 9.3% to $0.74851906Top LosersKAITO → Down 9.7% to $1.71POPCAT → Down 9.1% to $0.37289158IOTX → Down 7.6% to $0.02169712FARTCOIN → Down 7.5% to $1.05PENGU → Down 6.8% to $0.01021654Fear IndexBitcoin: 63Ethereum: 54DominanceBitcoin: 63.99% ▼ 0.27%Ethereum: 9.71% ▲ 1.18%Daily Net ETF FlowsBTC ETFs: $375.10 millionETH ETFs: $109.50 millionKey Data to Watch Today15:15 – ADP Non-Farm Employment Change (May)Forecast: 111K / Previous: 60K16:45 – Services Purchasing Managers’ Index (PMI) (May)Forecast: 52.3 / Previous: 50.817:00 – ISM Non-Manufacturing PMI (May)Forecast: 52.0 / Previous: 51.617:00 – Job Openings and Labor Turnover Survey (JOLTS) (April)Forecast: 7.110M / Previous: 7.192M17:30 – EIA Crude Oil InventoriesForecast: -2.900M / Previous: -2.795MGlobal MarketsGlobal stock markets are starting the day on an optimistic note. Expectations for high-level negotiations between the US and China have boosted risk appetite. US stock markets continued to rally, led by tech stocks, with the Nasdaq Index turning positive year-to-date. Yesterday, the Nasdaq rose 0.81%, the S&P 500 increased by 0.58%, and the Dow Jones added 0.51%, all closing in positive territory. The small-cap Russell 2000 Index gained 1.59%, supported by strong performances in regional banks and biotech stocks.Eight of the eleven sectors in the S&P 500 ended the day in the green. The technology sector performed best with a 1.48% gain, followed by energy (1.11%), materials (0.97%), and industrials (0.76%). On the other hand, telecommunications (-0.75%), real estate (-0.39%), and consumer staples (-0.15%) underperformed.On the macroeconomic front, the JOLTS job openings for April came in at 7.40 million, beating expectations of 7.11 million. However, factory orders shrank by 3.7%, exceeding the expected 3.1% decline. Today, the market focus is on the US ADP private sector employment data and the ISM services PMI. The ISM services index rose to 51.6 in April and is expected to increase slightly to 52 in May. Asian markets opened on a positive note, and European markets are also expected to open higher.Meanwhile, the OECD revised its “Global Economic Outlook” downward. The global growth forecast for 2025 was lowered from 3.1% to 2.9%, and the 2026 forecast from 3.0% to 2.9%. The US growth forecast for this year was cut from 2.2% to 1.6%, and the 2026 forecast from 1.6% to 1.5%. The report highlighted that uncertainties in trade policy, tight financial conditions, weakening consumer and business confidence, and rising political risks pose major threats to growth. New tariffs could increase trade costs and fuel inflation, although falling commodity prices might partially offset this.Growth forecasts for Turkey were also revised downward. The OECD cut Turkey’s 2025 growth forecast from 3.1% to 2.9%, and its 2026 forecast from 3.9% to 3.3%. Today, key international data include the US ISM services report, ADP employment report, and Eurozone Services PMI—all closely watched by markets.Top Companies by Market Cap and Stock PricesNVIDIA (NVDA) → $3.45 trillion market cap, $141.22 per share, +2.80%Microsoft (MSFT) → $3.44 trillion market cap, $462.97 per share, +0.22%Apple (AAPL) → $3.04 trillion market cap, $203.27 per share, +0.78%Amazon (AMZN) → $2.18 trillion market cap, $205.71 per share, -0.45%Alphabet (GOOG) → $2.02 trillion market cap, $167.71 per share, -1.56%Borsa IstanbulDomestically, the May CPI came in at 1.53% monthly—closer to our forecast (1.8%) and well below the market expectation (around 2.1%). This result aligns with the Central Bank’s inflation trajectory as outlined in its latest Inflation Report. Consequently, annual inflation dropped 2.5 points from the previous month to 35.4%. Our seasonally adjusted monthly inflation came in at 1.7%, showing about a 1-point improvement from April. Core inflation indicators also declined significantly: the B index annual inflation fell to 34.8%, and the C index to 35.4%. These developments signal continued downward momentum in inflation and improving pricing behavior, though a cautious stance remains warranted.Lower-than-expected inflation has increased the likelihood of a rate cut at the June Monetary Policy Committee (MPC) meeting. This triggered strong buying in banking stocks; yesterday the banking index rose by an average of 5.7%, and the BIST 100 gained 3.0%, closing at 9,277 points. Since the banking sector has underperformed the benchmark index by about 6% year-to-date, it may continue to recover this gap amid rate cut expectations. Additionally, pre-holiday settlement advantages also contributed to yesterday’s strong gains. Market attention is now turning to the June 19 MPC meeting.Technically, the BIST 100 showed a strong rebound after the previous two-day decline, recovering just below the support level. The 9,148–8,965 range remains a key support zone. If the index continues to trade above this band, a move toward 9,475–9,500 could be seen. The 9,325 level serves as interim resistance, and a close above 9,475/9,500 would signal short-term optimism, potentially targeting the 9,740–9,770 resistance area next. Key technical support levels for BIST 100 are 9,148/9,044, 8,965, 8,870, and 8,611; resistance levels are 9,325, 9,475/9,500, 9,588, and 9,740.Overall, a balanced sectoral performance with a continued upward trend is expected in Borsa Istanbul today.Top Companies by Market Cap in Borsa IstanbulQNB Finansbank (QNBTR) → 860.11 billion TL market cap, 260.25 TL/share, +1.36%Aselsan Electronic Industry (ASELS) → 581.86 billion TL market cap, 131.80 TL/share, +3.29%Garanti Bank (GARAN) → 478.8 billion TL market cap, 114.80 TL/share, +0.70%Turkish Airlines (THYAO) → 391.57 billion TL market cap, 284.75 TL/share, +0.35%Koç Holding A.Ş. (KCHOL) → 382.41 billion TL market cap, 149.40 TL/share, -0.93%Precious Metals and Exchange RatesGold: 4,231 TLSilver: 43.18 TLPlatinum: 1,369 TLUSD: 39.13 TLEUR: 44.59 TLSee you again tomorrow with more market updates!

New Era in South Korea: Crypto-Friendly Candidate Elected President

South Korea elected its new president after historic elections held on June 3rd. Lee Jae-myung, the Democratic Party candidate and opposition leader, was elected president with 49.42% of the votes in the election, the highest turnout in recent years. His conservative rival Kim Moon-soo remained at 41.15%. This result is quite critical for the Bitcoin and altcoin space. Because Lee Jae-myung is known as a pro-cryptocurrency politician.Pro-crypto candidate elected president in South KoreaThe South Korean presidential elections, the results of which were announced in the first hours of the day, were closely followed in the crypto market. Because it was known that Lee Jae-myung, one of the candidates, supported cryptocurrencies. Lee Jae-myung won the presidential elections, which took place with record participation, with 49.42% of the vote. The election carries the hope of a restructuring for the country, as it comes after a chaotic period that resulted in the failed coup attempt and impeachment of the previous leader Yoon Suk-yeol. Lee's campaign offered hope for economic recovery. However, it was also notable for introducing serious reforms on cryptoassets. What is on the new government's agenda?At the center of Lee Jae-myung's election promises is strengthening South Korea's position in the cryptocurrency market. The new president advocates the legalization of spot Bitcoin ETFs on local exchanges. Following the approval of spot ETFs in the US, the introduction of similar products in South Korea had caused excitement among investors. However, until today, the issuance and trading of such ETFs has remained prohibited in the country.Lee also plans to establish a stablecoin market indexed to the Korean won. Speaking at a policy meeting in May, Lee said, “A won-based stablecoin market is essential to prevent national wealth from fleeing abroad.”The new government's agenda also includes the second phase of crypto asset regulations. These regulations, which will focus on the transparency of stablecoins and crypto exchanges, aim to strengthen investor protection. On the other hand, Lee argues that regulations should be minimized in blockchain innovation zones. This will pave the way for tech startups and make South Korea more assertive in global competition.Lee Jae-myung is not the first president elected in South Korea with pro-crypto promises. The ousted former president Yoon also made similar promises, but no serious progress was made in practice. What is different this time is both the change in global markets and the increasing individual investor interest in South Korea. The number of users registered on crypto exchanges in the country has reached 9.7 million. This corresponds to about 20 percent of the population. It remains to be seen to what extent Lee Jae-myung's crypto-friendly policies will be implemented.

Donald Trump's Company's Bitcoin ETF Application Submitted to SEC

Truth Social, the social media platform owned by US President Donald Trump, has taken a remarkable step into the cryptocurrency world. The company's subsidiary Trump Media & Technology Group (TMTG) has filed an application with the US Securities and Exchange Commission (SEC) for an exchange-traded fund (ETF) called “Truth Social Bitcoin ETF”. The application was filed through NYSE Arca, the digital arm of the New York Stock Exchange.The effort to facilitate access to Bitcoin continuesAccording to the 19b-4 application form filed with the SEC in the first minutes of June 4, 2025, Turkey time, the fund will be structured to directly track the price of Bitcoin. The Truth Social Bitcoin ETF aims to offer investors an investment vehicle directly indexed to the BTC price, similar to previously approved spot Bitcoin ETFs. This fund is sponsored by crypto asset management company Yorkville America Digital. The institution that will provide custodian services is planned to be Foris DAX Trust Company, which is currently the custodian of Crypto.com.“Trump” name not used for investment productAccording to Eric Balchunas, a senior ETF analyst at Bloomberg, the application did not include any management fees or information on the fund's ticker. Also, the ETF documents do not directly mention the name “Trump”. However, Trump Media & Technology Group, the umbrella company of Truth Social, is clearly listed as backing the ETF. In order for the ETF to be officially traded, the SEC must approve not only the Form 19b-4, but also the S-1 registration statement, which provides detailed information about the investment vehicle. The S-1 documents contain detailed information on the fund's structure, management strategy and investment scope. Through these documents, the SEC has the chance to assess the level of transparency and risk the fund offers to investors.Bitcoin ETF race heats upTruth Social's move comes after spot Bitcoin ETFs, which were approved in 2024, attracted a lot of attention. Bitcoin ETFs already offered by giant institutions such as BlackRock, Fidelity, Bitwise and Grayscale have brought billions of dollars into the market. Following these developments, the SEC also gave the green light to Ethereum (ETH) ETFs. Now ETF applications for other cryptocurrencies such as XRP, Solana and Dogecoin are waiting in line.Trump's crypto initiative continuesTruth Social's ties to the crypto sector have become more apparent recently. At the beginning of the year, the company applied for six different trademark registrations related to Bitcoin and various investment products. Not content with this, Trump Media announced in recent weeks that it has raised $2.5 billion in capital and will use some of these funds to build Bitcoin reserves.