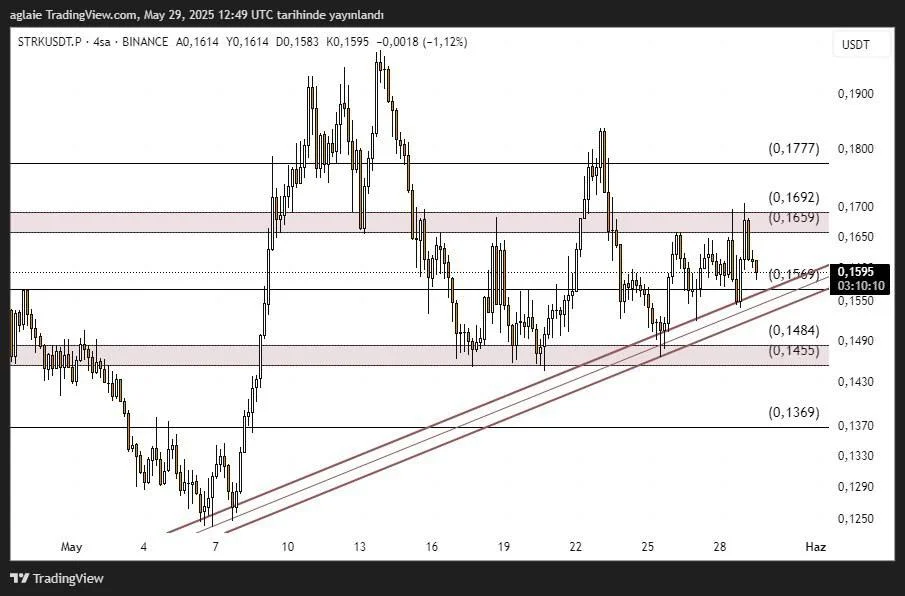

STRK 4H Technical Analysis

STRK continues to attract attention by preserving its short-term uptrend. On the 4-hour chart, the ascending structure is clearly visible, showing that buyers remain active and the price is avoiding lower lows. The current price is around $0.1595, hovering at a key inflection point.

The $0.1659–$0.1692 resistance zone has been tested multiple times by STRK, but the price has so far struggled to break through. This area has historically been a zone of increased selling pressure and high trading volume, making it a critical level. A breakout here could trigger a strong upward momentum.

Currently, the price is positioned just above the $0.1550–$0.1569 support range, which coincides with the short-term ascending trendline and former reaction zones. As long as bulls defend this level, the upward bias remains valid.

However, without a confirmed breakout above $0.1659, any upside attempts should be viewed cautiously. Sustained closes above this resistance are needed to confirm a bullish continuation.

Key Support Levels:

- $0.1569: Trendline support just below current price; important for short-term structure

- $0.1550: Lower boundary of the rising channel; buyer defense zone

- $0.1484–$0.1455: Key support in the event of a trend breakdown

- $0.1369: Major support in case of an oversold correction

Key Resistance Levels:

- $0.1659–$0.1692: Strong horizontal resistance zone; currently being tested

- $0.1777: Next target if the resistance above breaks decisively

Conclusion: STRK remains technically bullish as long as the ascending trendline holds. However, the $0.1659–$0.1692 range must be broken for a stronger upside leg to begin. If that happens, $0.1777 could be the next major target.

On the flip side, a breakdown below $0.1550 could threaten the bullish structure, potentially leading to a fast drop toward $0.1480. For now, both the trendline support and volume behavior should be closely monitored for confirmation.

Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.