OP

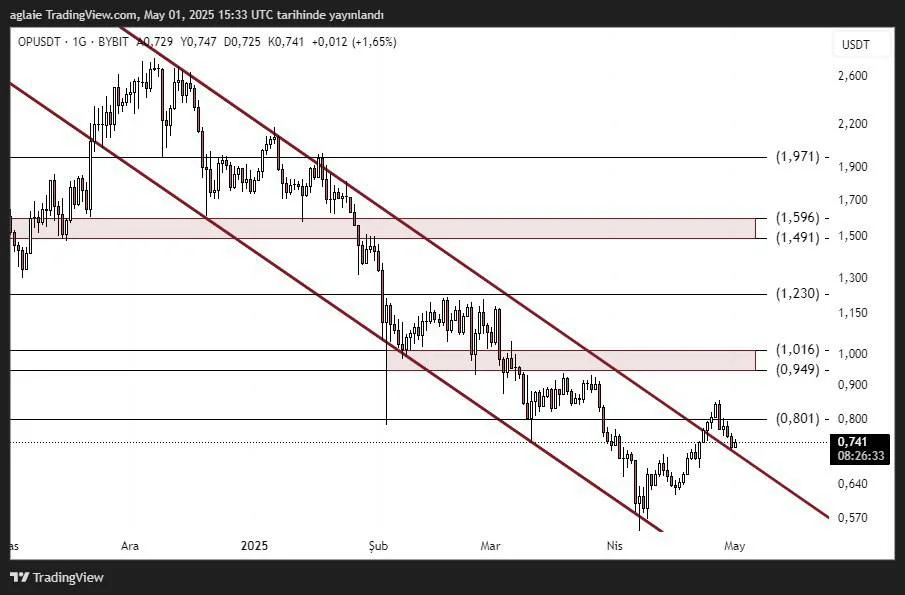

Optimism (OP) broke the falling channel structure in which it was trapped for a long time upwards and made a retest after this breakage. Currently, the price is trading at the level of $ 0.741, and the process until it reached this level presented a rather instructive structure from the point of view of technical analysis.

OP, which is outside the channel, first experienced a withdrawal after this fracture, then re-tested this region and confirmed it as support. So, in retrospect, the downward trend seems to be over. Now it is time for the price to break the resistance in front of it and enter a stronger upward process.

Support Zones:

- $0.700 – $0.680: Short-term support area

- $0.640 – $0.575: Main support

- $0,500 and below: Major support

Resistance Zones:

- $0.801: Deceleration resistance

- $0.949 – $1.016: Medium-term resistance band

- $1,230: The critical level for a broad-based trend reversal

- $ 1,491 – $1,596: The major resistance area that can be targeted during the continuation of the trend

- $1,971: Long-term target region

The rise that started from the bottom of the OP at the end of March seems to have entered a limited correction process as of now. The fact that the price tested the $ 0.801 level again and broke it this time may confirm the reversal of the trend by disrupting the channel structure.

if daily closures come above $0.801, the OP Coin will have exited the falling channel and the initial target may be the $0.95 – $1.01 band. In case of possible withdrawals, the December of $ 0.70 – 0.68 should be followed as a strong support. He is cautious in case he re-enters the channel, but if a fracture occurs, a more aggressive position can be taken.

As a result, the OP now seems ready for the upward process, along with the breakdown and retest of the falling channel in the big picture. Although there is a short-term correction process, a break of $0.801 in the coming days may be a harbinger of a new upward trend. For investors, this is a period that needs to be patient and careful right now.

These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.