USD1 is a stablecoin pegged 1:1 to the US dollar, launched in March 2025 by the World Liberty Financial (WLFI) ecosystem. This means that each USD1 token is backed by one US dollar and can be converted into cash for 1 USD when needed. This digital dollar aims to provide a fast, low-cost, and secure alternative to global digital payments by representing the traditional USD on the blockchain. Its reserves include short-term US Treasury bonds, US dollar deposits, and cash equivalents, which are held in trust and managed by BitGo. Thus, USD1 attempts to combine the strength of blockchain technology with the solidity of the US dollar in financial transactions. So how exactly does this digital dollar work? Let's take a closer look at the highlights of USD1, its reserve structure, and its areas of use.

USD1 Definition and Emergence

Fiat-backed stablecoins are a type of stablecoin that operates with reserve backing based on real-world assets. These assets are usually cash or cash equivalents (e.g. US government bonds), and these reserves help the stablecoin maintain its stable value. These stablecoins can be exchanged for fiat money at a one-to-one ratio by the issuer. For example, 1 USDC can be exchanged for 1 US dollar from Circle, the company behind USDC. This creates arbitrage opportunities when the value of USDC falls below $1, allowing investors to profit by buying USDC and then converting it into fiat. This arbitrage trading helps fiat-backed stablecoins maintain their dollar parity. USD1’s design is similar to USDC and USDT, fiat-backed stablecoin projects that hold a portion of their reserves in US Treasury bonds. Perhaps what sets USD1 apart is its connection to former US President Donald Trump.

| Feature | USD1 (Stablecoin) | Traditional USD (Fiat Currency) |

Issuing Entity | World Liberty Financial (WLFI) | U.S. Federal Reserve |

Collateral Structure | 100% fiat-backed (Treasury bills, USD deposits, cash equivalents) | Issued by the central bank; does not require collateral |

Blockchain Integration | Ethereum, BNB Smart Chain (BSC); integration with Tron and other networks upcoming | Not compatible with blockchain |

Transfer Time | Fast on-chain transfers within minutes | Hours or days depending on the banking system |

Transfer Fee | Low (based on blockchain transaction fees) | Varies between banks; generally high |

Use Cases | DeFi transactions, DEXs, staking, crypto investments | Daily payments, commerce, international reserve currency |

Availability | Available 24/7 | Dependent on banking hours, limited on public holidays |

Redeemability | Redeemable 1:1 for USD (via BitGo custody service) | No digital conversion; only usable through physical cash or bank accounts |

Transparency & Tracking | On-chain transaction history viewable | Transactions are closed system, traceable only via bank records |

Regulatory Status | Claimed to be under U.S. regulatory oversight, but lacks full transparency | Fully subject to federal regulations and monetary policy |

Political/Institutional Ties | Linked to Donald Trump and his family | Government-controlled, politically neutral |

USD1 is a stablecoin pegged 1:1 to the US dollar, launched by World Liberty Financial (WLFI) in March 2025. World Liberty Financial was introduced in connection with current US President Donald Trump and his family. USD1's reserves are held by BitGo, a crypto asset custodian. The majority of the reserve assets consist of US Treasury bonds, dollar deposits, and cash equivalents. Just like other major stablecoins such as USDC and USDT. So, what exactly is USD1? As its name suggests, USD1 is a cryptocurrency pegged to 1 US dollar (1:1 backed). Also known as World Liberty Financial USD and developed by this company, USD1 aims to serve both institutional and retail investors by transferring dollar collateral from the traditional banking system to the blockchain infrastructure. According to the project's description, the USD1 token is sharply designed so that each unit is necessarily held in exchange for US dollars. It is also emphasized that the reserve portfolio will be regularly audited. In other words, the assets behind the stablecoin are intended to be verified by independent auditors. Thus, users can convert 1 USD token into 1 US dollar at any time. So the answer to the question "Is USD1 pegged to the dollar?" is "yes". USD1 coin features are as follows:

- It is a digital currency pegged to the equivalent value of 1 USD.

- The networks it works on: It uses Ethereum and BNB Smart Chain (BSC) blockchains. Integrations are aimed for it to be used in other chains in the future.

- Purpose of use: The purpose of USD1 is to reduce the volatility brought by the traditional dollar and to provide a fast, secure representation of the dollar in the digital environment. Institutional and individual users can make cross-border payments with USD1, participate in DeFi applications and keep stable value similar to the US dollar in their crypto wallets.

- Developer company: World Liberty Financial is a US-based (Delaware establishment) DeFi protocol and governance platform. The company emphasizes that it aims to transform the world of finance with blockchain technology and popularize dollar-collateralized digital assets.

History of USD1: Major Milestones

USD1's launch is closely related to the founding activities of World Liberty Financial. Announced as a DeFi project supported by the Trump family as of 2024, WLFI launched its first cryptocurrency WLFI in October 2024. Then, in March 2025, WLFI announced its new USD1 stablecoin pegged to the dollar. In the official statement made at this time, it was stated that USD1 would be 100% backed by US Treasury bonds, dollar deposits and cash equivalents and would be printed on both Ethereum and BSC. The timeline for this new cryptocurrency is as follows:

- October 2024: World Liberty Financial was introduced as a new crypto finance initiative backed by the Trump family. The WLFI token was launched in the same month.

- March 2025: USD1 Stablecoin was announced. WLFI announced that USD1 would be 1:1 backed by USD and its reserves would be held entirely in short-term US Treasury bonds and cash. Initially planned to be used on Ethereum and BSC networks.

- April 2025: At the Token2049 conference in Dubai, Eric Trump announced that USD1 would be integrated into the Tron network. This statement reinforced Tron founder Justin Sun’s support for WLFI. During the same period, Abu Dhabi-based MGX fund announced that it would invest $2 billion in Binance using USD1.

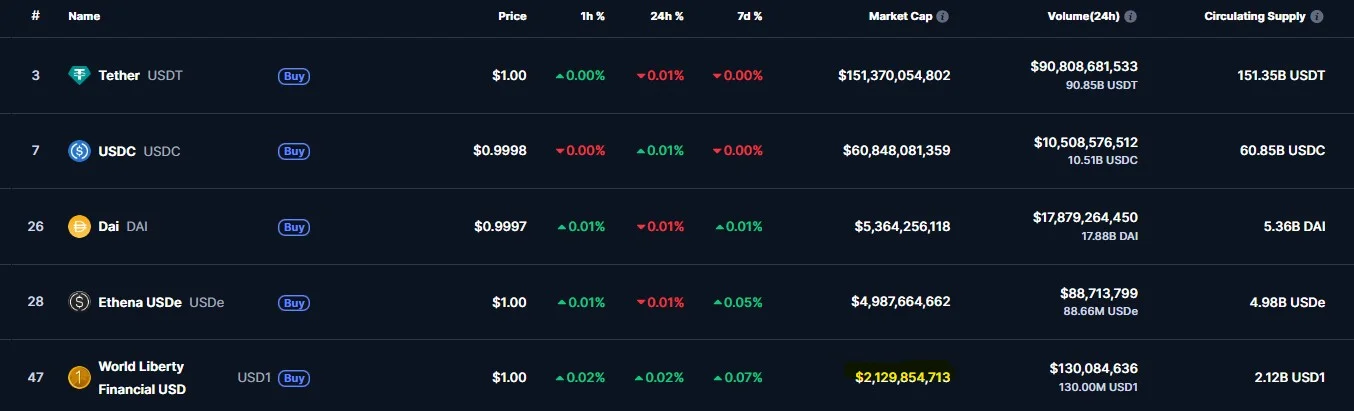

- May 2025: Multi-blockchain integration is completed thanks to Chainlink’s CCIP technology. The World Liberty Financial and Chainlink teams announced that USD1 can be securely moved between Ethereum, BNB, and other chains. In the same month, USD1’s market value exceeded $2 billion and climbed to the top of the stablecoin rankings.

- WLFI approved an airdrop plan for USD1 holders (it was stated that token distribution could be made). In this process, information was shared that the largest voting power was concentrated in a few large wallets, and regulatory and political discussions regarding the project continued. This airdrop took place in the first weeks of June.

Why is USD1 Valuable?

The value of USD1 is based on several important features. First, its price remains fairly stable thanks to its peg to 1 USD. It does not have a high volatility like stocks or cryptocurrencies. This allows investors and institutions to trust USD1 as a tool that protects its value in dollars. In addition, USD1 has a fiat-backed reserve system: Each unit is backed by US Treasury bonds and similar real assets. The fact that these reserves are held by BitGo and that regular third-party auditing is scheduled also provides its value.

USD1 is accessible and cost-effective for the DeFi ecosystem. It offers low transaction fees and fast confirmation times by conducting transactions on networks such as Ethereum and Binance Smart Chain. Unlike bank transfers, it works 24/7 and can be used without any geographical restrictions. Since it works on a trackable infrastructure on the blockchain, transactions are highly transparent. Because users can follow the flow of USD1 on the chain.

In addition, the fact that USD1 was developed within the American legal framework provides a regulatory advantage. The US administration has recently taken steps to regulate stablecoins. Dollar-pegged cryptocurrencies like USD1 are subject to reserve holding rules in accordance with American legislation. This may be seen as “US-backed stability” in global markets and may attract the attention of institutional investors. For example, according to some, USD1 offers a confidence-boosting profile against its competitors such as USDT and USDC due to its backing by US Treasury bonds and real assets under BitGo supervision.

Institutional Growth Strategy

USD1’s growth is largely based on institutional agreements. The Binance-MGX agreement is the biggest example of this. As we mentioned before, USD1 was used in the completion of the $2 billion investment agreement between Binance and Abu Dhabi-based MGX in April 2025. This development brought USD1’s market value to over $2 billion, making it the fastest-growing stablecoin in history. The WLFI team aims to grow by focusing on large investors and institutional players rather than retail usage. This different approach sets it apart from stablecoins such as USDT and USDC.

Possible risks of USD1

Although USD1 has attracted attention with its rapid growth and institutional partnerships, the project still has some uncertainties as it is still new. Issues such as reserve transparency, liquidity status and political background are among the important risk headings that investors should consider. Let's take a closer look at the potential risks of USD1 below.

Lack of auditing

As of the time of writing, there is no information on the breakdown of USD1's reserves. In other fiat-backed stablecoins such as USDC and USDT, the asset and liability records of the issuers are shared regularly, allowing users to verify that the stablecoin is supported. However, the USD1 project says that each USD1 issued will be 100% backed by short-term US Treasury bonds, dollar deposits and other cash equivalents, and the reserve portfolio will be regularly audited by third-party accounting firms.

Lack of liquidity

Since it is a new project, it is not clear where users will be able to find liquidity when they want to buy and sell USD1. There are currently no alternatives other than Ethereum and two relatively small DEX pools on BSC and HTX. However, it is currently in the testing phase, and well-known crypto market maker Wintermute is involved in the project, which may increase confidence in the project. Another market maker, DWF Labs, also recently invested in WLFI and could potentially be involved in the project. It is currently unclear what the repatriation mechanism will be between USD1 and the real dollar, but it is likely to be conducted through the custodian firm BitGo.

Perception of political orientation

When commenting on US crypto regulation, CEOs of other stablecoin issuers, such as Tether, emphasize that the success of stablecoins depends more on the success of the US. However, since USD1 was launched by World Liberty Financial, a decentralized finance initiative backed by Trump and his family, this new stablecoin is perceived to have a direct connection to the US President.

Who is World Liberty Financial?

World Liberty Financial (WLFI) is a US-based Web3 financial company. Founded in 2024, this DeFi protocol aims to replace traditional finance and provide users with access to financial services without intermediaries. The company is working to create “crypto banking” with blockchain technology: Users can borrow by using crypto assets as collateral, and earn income by investing their assets in blockchain applications. WLFI’s vision is to democratize financial instruments and provide secure services with USD support. The main projects in World Liberty Financial’s ecosystem are:

- USD1 stablecoin: As previously detailed, it is a stable cryptocurrency pegged to the US dollar. It acts as a digital dollar in the crypto world.

- WLFI token: The project’s governance token, $WLFI, provides a say in on-platform voting. WLFI token holders can contribute to protocol decisions.

- TRUMP meme coin and NFT: World Liberty has also entered Trump-themed digital assets. In January 2025, a memecoin called $TRUMP was launched, and various collectible NFTs were offered. Thus, it aims to increase community interest on both the DeFi and entertainment side.

- DeFi and debt instruments: The platform also develops financial instruments that allow users to lend (staking) or take out loans against crypto assets. For example, WLFI is trying to create blockchain banking by offering lending and interest-earning opportunities to its investors.

In addition to emphasizing transparency, World Liberty Financial states that USD1 reserves are stored by BitGo and that third-party audits will be conducted regularly. It also seems to care about user experience: It was announced that it will offer conveniences such as 24/7 mint and refund support. WLFI carries the image of an “American-based stablecoin” in the crypto market thanks to its US-based structure and being backed by dollar reserves.

Frequently Asked Questions (FAQ)

Finally, we have compiled the most curious topics of users who want to learn more about USD1 in this section. You can find answers to many questions below, from how USD1 works to which networks it is used, and from World Liberty Financial's projects to the differences between USD1 and other stablecoins such as USDT and USDC:

- What is USD1, how does USD1 work?: USD1 is a stablecoin pegged to the US dollar issued by World Liberty Financial. It is traded on blockchain networks such as Ethereum and BNB Smart Chain. Each USD1 token is backed by dollar reserves held behind it and can be bought and sold for 1 USD via the BitGo infrastructure. Users request a USD1 mint (printing) by sending USD and can convert it back to 1:1 USD whenever they want.

- Is it really pegged to 1 USD?: Yes, project officials state that USD1 is 100% backed by the US dollar and each unit is convertible to 1 USD. In other words, in theory, its value is pegged to the dollar and secured by short-term treasury bonds. However, since independent audit reports have not been fully shared with the public so far, it is expected that all reserves will be audited.

- On which platforms is USD1 used?: Currently, USD1 can be traded on Ethereum and Binance Smart Chain (BSC). According to the announcement made at the Token2049 conference, it will also be integrated into the Justin Sun-backed Tron network. In addition, thanks to the Chainlink CCIP integration, USD1 has become transferable between multiple blockchains. In other words, it will be possible to keep USD1 in your wallet on different blockchains in the future.

- What kind of projects does World Liberty Financial carry out?: World Liberty Financial develops staking, lending and governance tools as a DeFi protocol and financial platform. It aims to provide crypto credit and savings services worldwide. It also launched a Trump-themed memecoin called $TRUMP and supported NFT projects. In short, it has established an ecosystem that includes the USD1 stablecoin, WLFI token and digital asset investments.

- Is there a difference between USD1 and stablecoins like USDT, USDC?: Functionally, USD1 is a stablecoin pegged to 1 USD, like USDT or USDC, but the support mechanism and infrastructure are different. The reserve structure of USD1, just like USDT/USDC, is held in US Treasury bonds. The difference is: USDT (Tether) and USDC (Circle) are stablecoins that have been in the market for a long time and are managed by different companies. USD1, on the other hand, is relatively new and is backed by an institutional custodian like BitGo. While USDC is subject to strict regulatory controls, USD1 claims to hold transparent reserves in a similar way. In short, they are all collateralized by dollars; the difference between them is how the reserves are managed, which companies issue them, and their legal infrastructure.

Get to know the digital dollar and prepare for the future of finance — Follow our JR Kripto Guide series for more information on USD1 and World Liberty Financial.